China’s 2011 fiscal revenue up 24.8% to 10 trillion yuan

如果从这2万忆中拿出10%作军费那就是2000亿美元军费,远远超出日本,俄罗斯,印度的总和。

中国政府根本就不是没有钱,而是不知道该用在关键的立国之本上。

BEIJING, 2012 Jan. 20 (Xinhua) — China’s Ministry of Finance said on Friday that the nation’s fiscal revenue grew 24.8 percent year-on-year to hit a record high of 10.37 trillion yuan (1.64 trillion U.S. dollars) in 2011.

Of the total, the central fiscal revenue reached 5.13 trillion yuan, up 20.8 percent from the previous year, while local governments collected 5.24 trillion yuan, up 29.1 percent, the ministry said in a statement on its website.

Tax revenue rose 22.6 percent year-on-year to 8.97 trillion yuan last year, and non-tax revenue surged 41.7 percent to 1.4 trillion yuan, the ministry said.

The ministry attributed the increase to relatively fast economic growth, price hikes, surging corporate income tax and the move to bring non-budgetary funds into its budget management.

Corporate income tax rose 30.5 percent from a year earlier to 1.68 trillion yuan, boosted by the good economic returns of enterprises, the ministry said.

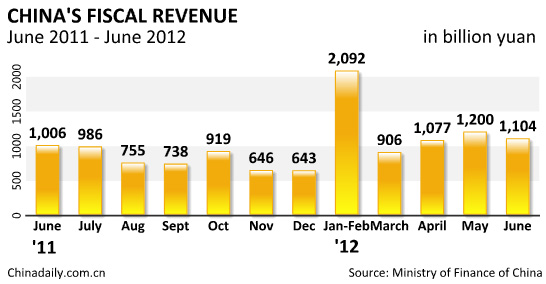

On a quarterly basis, the growth of the nation’s fiscal revenue slowed last year, caused by an economic slump, personal income tax reform, easing inflation and waning transaction volumes in the country’s auto and property sectors, it said.

Fiscal revenue growth fell to 10 percent in the fourth quarter of last year, compared with 33.1 percent in the first quarter, 29.6 percent in the second quarter and 25.9 percent in the third quarter, it noted.

China’s economy expanded by 9.2 percent year-on-year in 2011, with its GDP growth rate dropping to a ten-quarter low of 8.9 percent in the fourth quarter of last year, according to the National Bureau of Statistics.

The ministry said personal income tax stood at 605.4 billion yuan in 2011, up 25.2 percent from a year earlier. The tax fell 5.5 percent year-on-year in the fourth quarter of the year after the government raised the personal income tax threshold in September.

Meanwhile, fiscal expenditure nationwide rose 21.2 percent year-on-year to 10.89 trillion yuan in 2011, the ministry said.

Central fiscal expenditure reached 5.64 trillion yuan, while local governments, which received 3.99 trillion yuan in tax rebates and transfer payments from the central budget last year, spent 9.24 trillion yuan, it said.

The fiscal expenditure structure was further optimized last year, the ministry said, adding that it has strengthened support to sectors concerning people’s livelihoods, such as education, medical and health care, social security, employment, housing and culture.

Fiscal revenues in China include taxes as well as administrative fees and other government income, such as fines and income from state-owned assets.

中国财政收入首破10万亿元大关

新华网北京1月20日电(记者韩洁、徐蕊、何雨欣)中国财政部20日发布的数据显示,2011年中国全年财政收入首次突破10万亿元大关,达到103740亿元,比上年增长24.8%,创下历史新高。同时,全年财政支出108930亿元,比上年增长21.2%。

2011年中国财政收入的新飞跃,延续了近些年财政收入持续较快增长的势头。2002年中国财政收入为1.8万亿元,2003年突破2万亿元,2005年突破3万亿元,2007年突破5万亿元,2010年突破8万亿元。

从横向视角来看,近几年,美国财政收入保持在4.5万亿美元左右,英国、法国、德国、日本等工业化国家保持在8500亿美元到1.5万亿美元之间,在国际比较中可以看出,中国财政收入的总体规模已不小。

分析人士指出,在近几年世界经济持续低迷的背景下,中国经济的稳步上升无疑为财政收入的快速增长提供了有力保证。

目前,中国经济总量已经站在世界第二的位置,经济的增长直接带动税收的增加。财政部数据显示,逾十万亿元的财政收入中,税收收入为89720亿元,同比增长22.6%。去年中国工业增加值增长13.9%、固定资产投资增长23.8%、社会消费品零售总额增长17.1%、进出口总额增长22.5%,相应带动增值税、营业税、进口环节税收等较快增长。

财政部财科所副所长苏明指出,2011年中国全年居民消费价格(CPI)和工业生产者出厂价格(PPI)上涨也带动相关税收增长。同时,企业效益的提高也带动去年企业所得税实现30.5%的高增长。

不过值得关注的是,虽然目前中国财政收入总体规模已较大,但人均财政收入水平仍较低,据财政部介绍,目前中国人均财政收入水平的世界排名处于百位之后。

“应该说,中国财政收入的总体规模并不小,但财政收入占GDP的比重与发达国家仍有差距,这根本原因是发展阶段不同,发达国家财政收入占GDP的比重较高,政府对居民的社会保障标准也比较高,这对我国而言,是个循序渐进的过程。” 苏明说。

此外,财政部数据显示,2011年一季度全国财政收入增长33.1%,二季度为29.6%,三季度降为25.9%,到四季度只有10%,明显的前高后低态势表明中国财政收入增势隐忧已现。

对此,财政部表示,去年财政收入前高后低,主要受经济增长逐步放缓、企业利润下滑、物价高位回落,特别是四季度后提高个人所得税起征点减收较多,以及汽车和房地产成交量下降相关税收减少等因素影响。

财政部部长谢旭人不久前在部署2012年财政工作时指出,2012年国际经济形势仍存在不确定性,同时适应结构调整需要,国内经济增速会放缓、企业利润增速恐下降,加上结构性减税力度加大,财政收入增速会有所回落。

苏明指出,在“十二五”加快调整经济结构的背景下,2012年中国各项财政支出压力也将进一步凸现,2012年要实现国家财政性教育经费支出占国内生产总值4%的目标、新型农村社会养老保险和城镇居民社会养老保险制度实现全覆盖等,都需要进一步加大财政投入力度,财政支出压力较大,预计财政收支压力将显现。

2015 财政收入

2014年,我国GDP增速以7.4%创下24年来新低。

在去年一般公共财政收入的140350亿元中,税收收入119158亿元。2013年,税收收入为110497亿元,税收收入增长有限。